Why Alternative Investments?

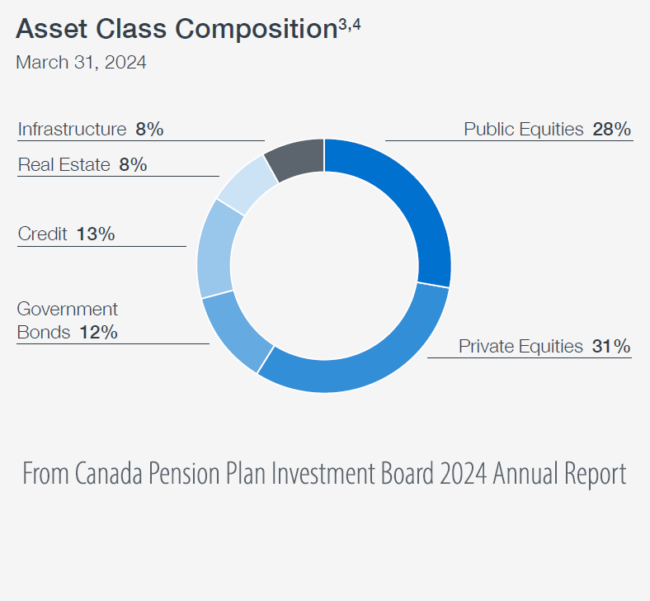

Pension funds like Canada Pension Plan typically only keep 40-60% of their holdings in public markets.

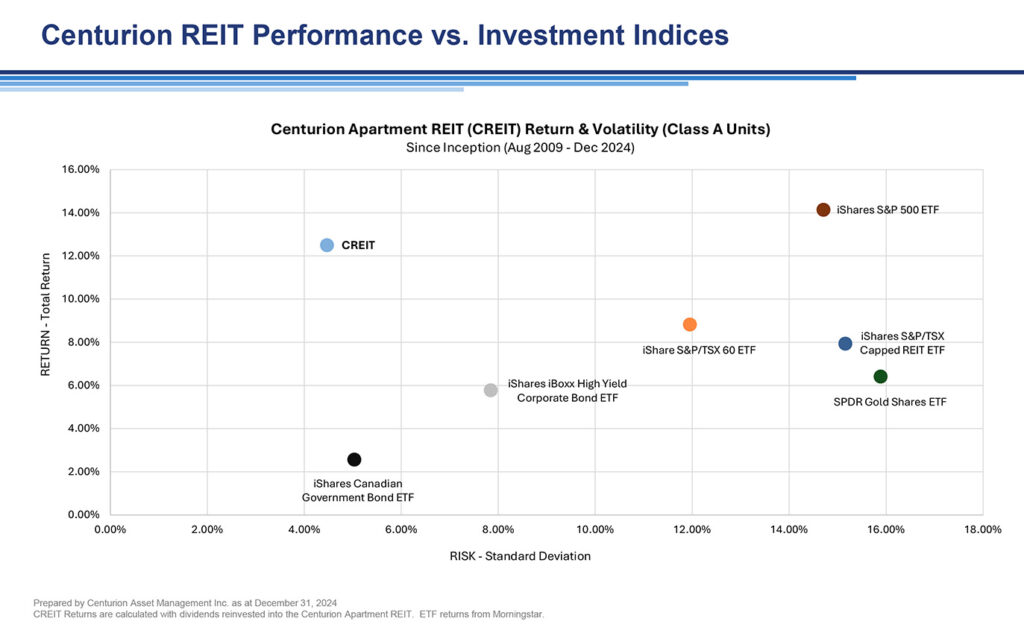

Alternatives can offer consistent investment performance.

Consistent, double-digit returns can occur.

Low or no correlation to public stock markets.

Can offer regular cash flow, predictable liquidity.

Some offer tax efficiencies.

Not just for High-Net-Worth investors – open to all investors.

About Gale Force Alternative Investments

Gale Force Alternative Investments is led by Tony Gale, and is a division of Waverley Corporate Financial Services Ltd. Tony has been a Waverley Dealing Representative since 2021. Prior to that, and currently, Tony consults with clients on topics of financial education, modelling and tool development.

The alternative investments space has typically been reserved for the ultra wealthy. Gale Force Alternative Investments, through its association with Waverley Corporate Financial Services Ltd. is able to democratize these offerings to most everyday investors.

Tony has also instructed numerous courses in Finance/Personal Finance at the university level since 2007.

Tony Gale MBA, P.Eng.

Visit Waverley Corporate Financial Services Ltd.

waverleycf.com

Waverley Corporate Financial Services Ltd. is an Exempt Market Dealer registered in the provinces of British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, and Nova Scotia.